Dashboards That Drive Strategy

Connecting the Dots: dashboards and reporting metrics that drive performance & efficiencies

Project Snapshot

- Role: Strategy, Reporting, and Ops Lead

- Timeframe: 2020–2024

- Focus: Dashboard design, cross-functional reporting, agency enablement, cohort tracking

- Tools Used: GA4, BigCommerce, Looker Studio, Excel, Amplitude, SQL/CSV exports

Situation

I often become the go-to for reporting build outs as I’m rarely deterred by not having the data.

Across multiple eCommerce and DTC brands, reporting was fragmented. GA and backend systems weren’t aligned. PMax lacked visibility. No single source of truth existed for executive reporting or performance insights. I often became the go-to for reporting build outs as I’m rarely deterred by not having the data. I have built countless reports from the ground up and that’s served me (and my teams) well!

Challenges

- Lack of transparency into customer acquisition cost (CAC), return behavior, and LTV

- Executive meetings lacked consistent reporting that helped the team understand how efforts were translating into sales revenue

- Agencies needed to be educated on internal data limitations (e.g. “new to system” ≠ new customer)

- Platform UIs (e.g. BigCommerce, Google Ads) were siloed in their “walled gardens” and didn’t provide enough actionable data by default

Approach

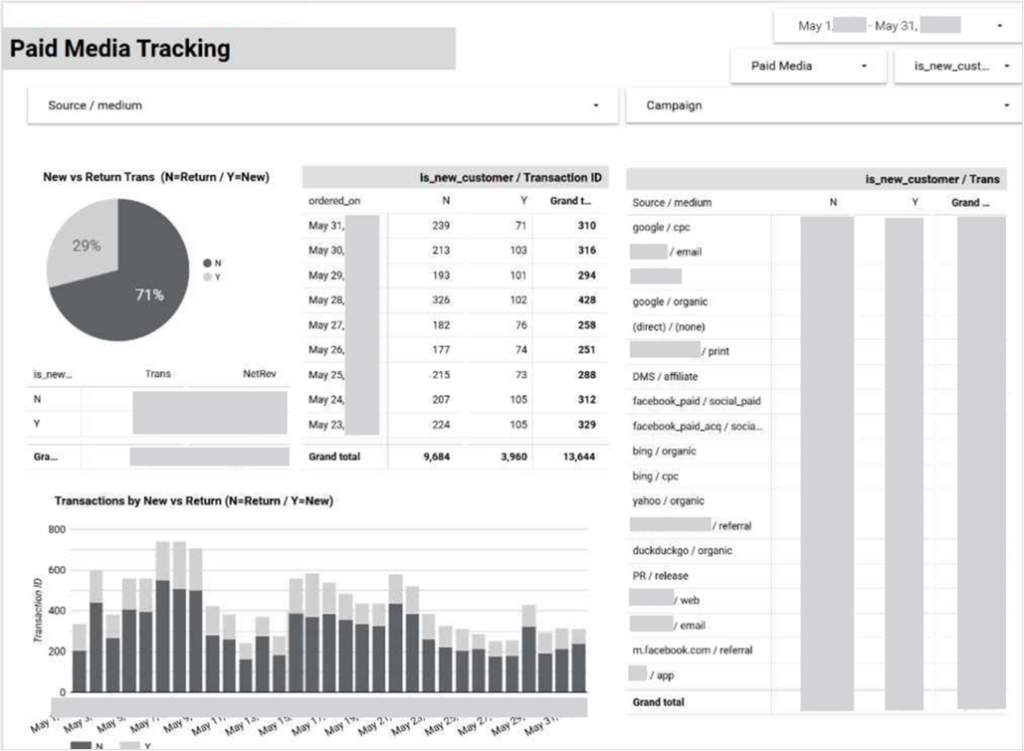

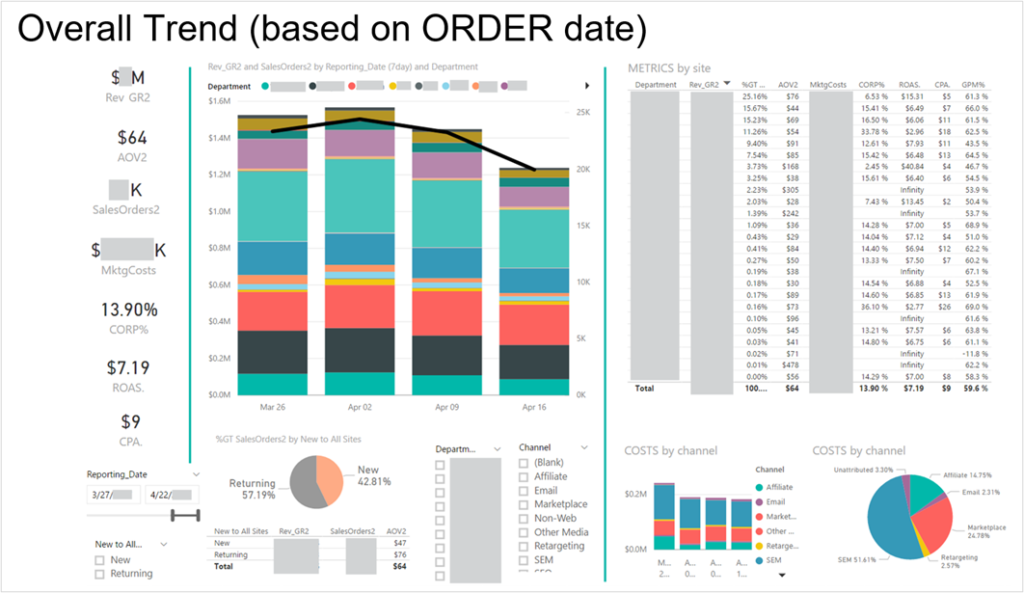

Unifying GA & Backend Data for Cross-Channel Clarity

- Joined GA + backend data from disparate systems to track New vs. Return performance

- Created channel-level dashboards for daily use by internal and agency teams

- Used this view to spot lift by channel, campaign, and customer type

This channel-level dashboard joined GA and backend transaction data to surface New vs. Return customer trends. Used by internal teams and agency partners, it became a critical tool for analyzing acquisition performance, understanding repeat behavior, and optimizing media allocation. Metrics have been anonymized.

Insight/Action: Enabled the team to optimize spend by channel, focusing on New vs. Return customer revenue. By analyzing performance by day, we could reallocate budget based on engagement patterns.

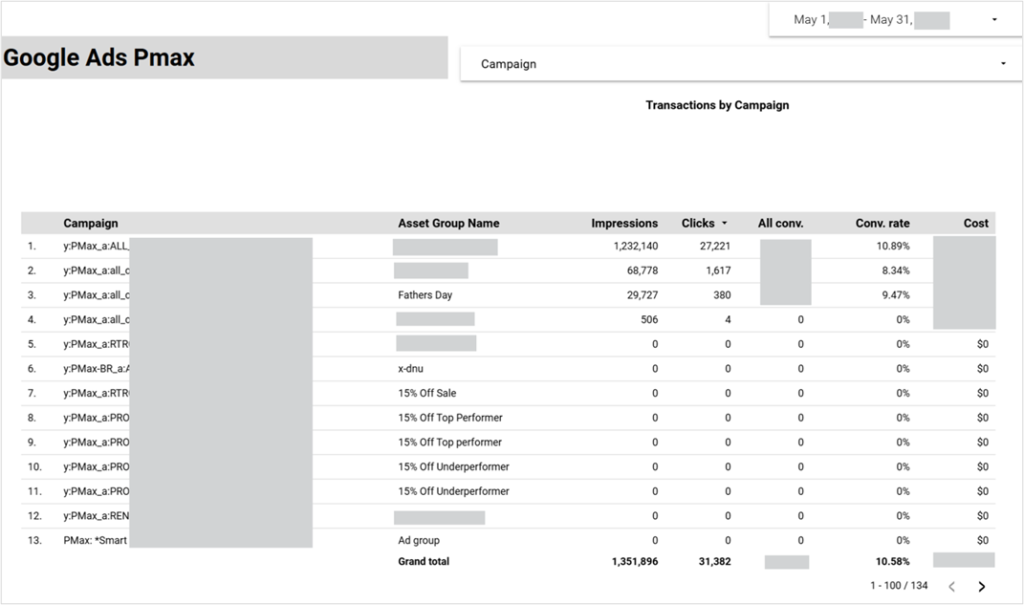

Cracking the Black Box: Unlocking PMax Performance Drivers

- Built a custom report in Looker Studio that broke down performance by Asset Group and campaign

- Enabled copy and creative optimization the platform’s UI didn’t support

- This became a primary resource for strategic media recommendations

This Looker Studio table was developed as a lightweight workaround to expose performance data from Google’s opaque Performance Max campaigns. While not visually refined, it delivered immediate insight into asset-level contribution and became a go-to resource for optimizing PMax campaigns when no native visibility existed.

Insight/Action: Surfaced asset group-level performance, enabling creative and copy optimizations previously unavailable in the default PMax UI.

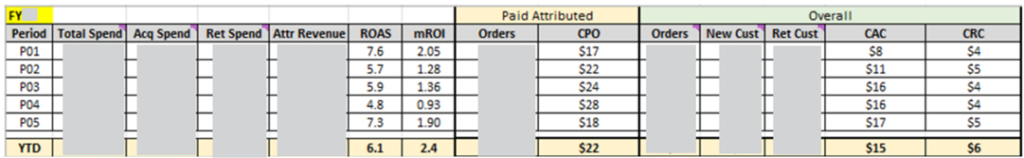

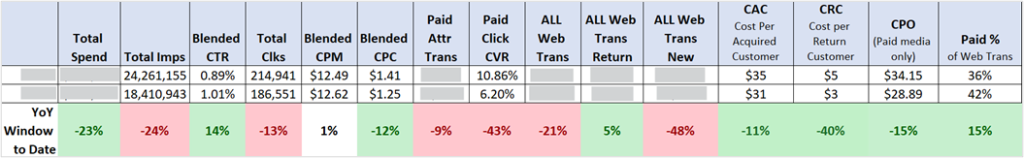

Building CAC & CRC Models to Drive Strategic Decisions

- Used custom logic to differentiate truly new vs. repeat customers

- Developed a report showing CAC and CRC trends over time, supporting finance + marketing discussions

- Partnered with the CMO and CFO to align reporting with growth strategy

This report view introduced cost-per-customer modeling (CAC and CRC) to help finance and marketing align on spend efficiency and profitability. It was used in strategic planning and performance reviews with senior leadership. Financial figures have been rounded or blurred for confidentiality.

Insight/Action: Helped guide spend discussions with the CFO/CMO by showing how adjustments impacted CAC/CRC. This dashboard became the go-to reference for understanding revenue impact from new vs. return customers.

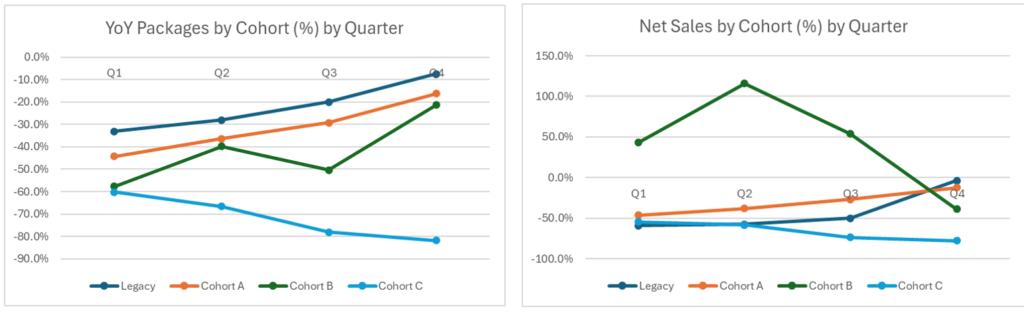

Cohort & Retention Analysis for Long-Term Growth Insights

- Tracked package counts and revenue by acquisition cohort across Year-over-Year (YoY)

- Highlighted retention drops, revenue shifts, and customer quality trends

- Used this data to inform offer design, email segmentation, and repeat purchase lifecycle planning

This cohort report tracked package count and revenue by acquisition year, offering insights into customer retention, repurchase behavior, and revenue contribution over time. It was used to inform promotional cadence and lifecycle messaging strategy. Values are representative but anonymized.

Insight/Action: Revealed changes in cohort health, prompting offer tests for declining revenue segments. For example, when one cohort showed increased orders but lower revenue, we adjusted pricing strategies to address it.

Driving Adoption Through Impactful Data Visualization

- Delivered weekly reports across creative, email, promo, and site metrics

- Reported A/B/C email results and offer performance

- Connected department workstreams through a single performance lens

This snapshot was part of a weekly cross-functional performance deck shared across marketing, creative, and product teams. It tracked campaign impact, creative testing, channel lift, and operational flags. It played a key role in aligning weekly priorities across departments. Brand names and figures have been anonymized.

Insight/Action: Reduced weekly meeting time by over 50% by replacing siloed updates with a unified performance view. First time the entire team aligned around shared metrics.

Optimizing Media Mix to Drive Brand Consideration

- Diversified paid media in a single test market: digital, streaming audio, and radio

- Third-party brand health studies showed a 29% lift in brand consideration after media diversification

- Media mix was the only major change, isolating its impact

Third-party brand health tracking, 6-month study.

Insight/Action: Validated the role of channel diversification in strengthening upper-funnel metrics and reinforced pairing brand health studies with performance reporting for measurable outcomes.

Created Executive Summary Frameworks

- Simplified dashboards with scorecards for execs:

- Net Revenue, Total Transactions, New Customers, CAC, CRC

- Built narrative-based summaries for Monday meetings when others weren’t delivering

- Became a default voice for data across exec, finance, and marketing teams

This dashboard was used in weekly executive meetings to provide a clear read on paid media efficiency, customer acquisition cost (CAC), return behavior, and channel-level contribution. Key financial and transaction metrics have been blurred to maintain confidentiality while preserving the overall structure and story.

Insight/Action: Used to push back on blanket spend cuts by showing the effect of reduced investment on customer acquisition costs and return behavior. Supported more nuanced budget decisions.

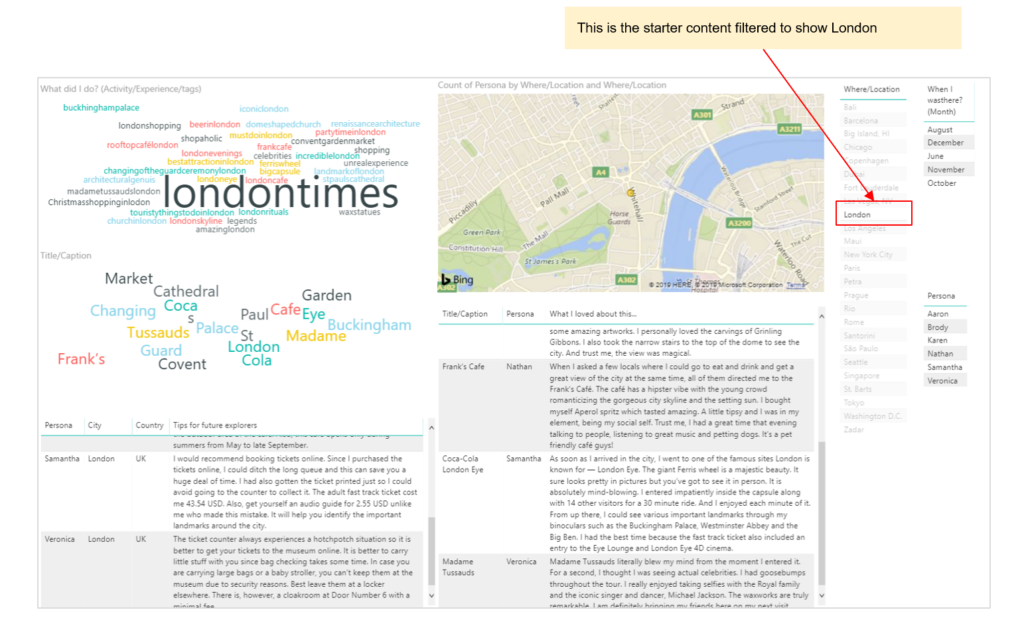

Built Content & Persona Dashboards for UGC Strategy

- Created dashboards to track content volume by destination, persona, and content type using hashtag tagging and moment-level data

- Visualized geographic coverage gaps to inform creator outreach and content marketing strategy

- Helped identify high-performing UGC topics to prioritize in platform UI and editorial planning

- Monitored content submission trends by tag and persona cluster to optimize onboarding prompts and email triggers

This dashboard visualized tagged moments across cities and personas, highlighting top-performing themes and helping guide creator activation. Built in Power BI. Values anonymized.

Insight/Action: Guided tagging and persona segmentation strategy across product and development by surfacing content volume by theme, geography, and user type.

Results & Outcomes

- Unified disparate tools into clean dashboards used weekly by execs, agency, and ops teams

- Created shared understanding of what metrics mattered — and why

- Elevated reporting from tactical to strategic

- Built credibility as the go-to for operational visibility and financial insight

Reflection

Dashboards are only useful if they help people make decisions. My goal was never to make pretty charts — it was to bridge the gap between messy data and confident action.